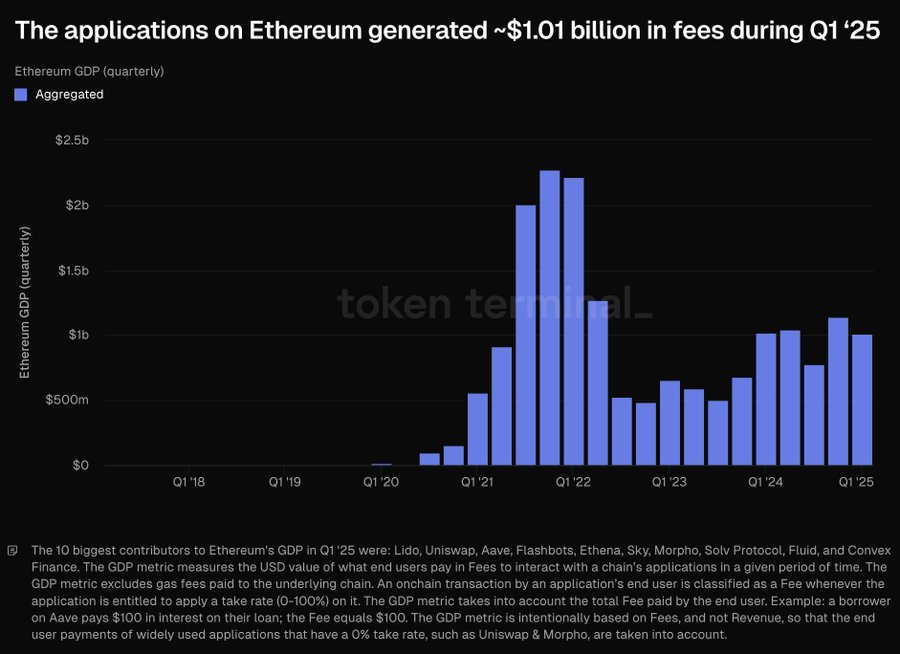

- Ethereum’s Q1 2025 DApps generated $1.01 billion in charges

- Ethereum whales dropped by 10%, and retail exercise has been declining too

Ethereum’s [ETH] DApps raked in a powerful $1.01 billion in charges throughout Q1 2025, showcasing the power of the community’s ecosystem. This, regardless of Ethereum’s personal underwhelming efficiency over the identical interval.

Nonetheless, there’s a refined shift occurring beneath the floor – The variety of Ethereum whales has dropped by 10% since February, hinting at a possible change in investor sentiment.

May the rise of DApps be masking deeper issues about ETH’s long-term prospects?

A billion-dollar quarter, however ETH nonetheless lags behind

Regardless of Ethereum’s ecosystem raking in over $1 billion in software charges, ETH itself has been one of many worst-performing main property in Q1 2025.

In response to latest knowledge, ETH dropped by a staggering 41.63% between January and April, underperforming each Bitcoin and the S&P 500.

This disconnect between community utility and token worth hinted at a troubling divergence – DApps could also be thriving, however ETH holders are feeling the warmth.

Whereas utilization stays strong, the market seems unconvinced of ETH’s worth as a capital asset. Quite the opposite, Bitcoin holds firmer floor, additional intensifying the narrative that Ethereum could also be shedding its grip because the market’s second most trusted wager.

Ethereum – Whales retreat, retail weakens

Ethereum’s worth woes appeared to be mirrored by a pointy retreat in each whale and retail community exercise. Addresses holding over 10,000 ETH have dropped by nearly 10% since mid-February, falling from 999 to only 896 as of 04 April – An indication of deep-pocketed disinterest or rotation.

Nonetheless, the exodus isn’t restricted to establishments. Every day lively addresses steadily declined all through March and nosedived in early April, now hovering close to 205,000.

The mixture of fading whale confidence and dwindling grassroots utilization alludes to a broader capitulation throughout Ethereum’s consumer base. This additionally paints a bleak on-chain image heading into Q2.

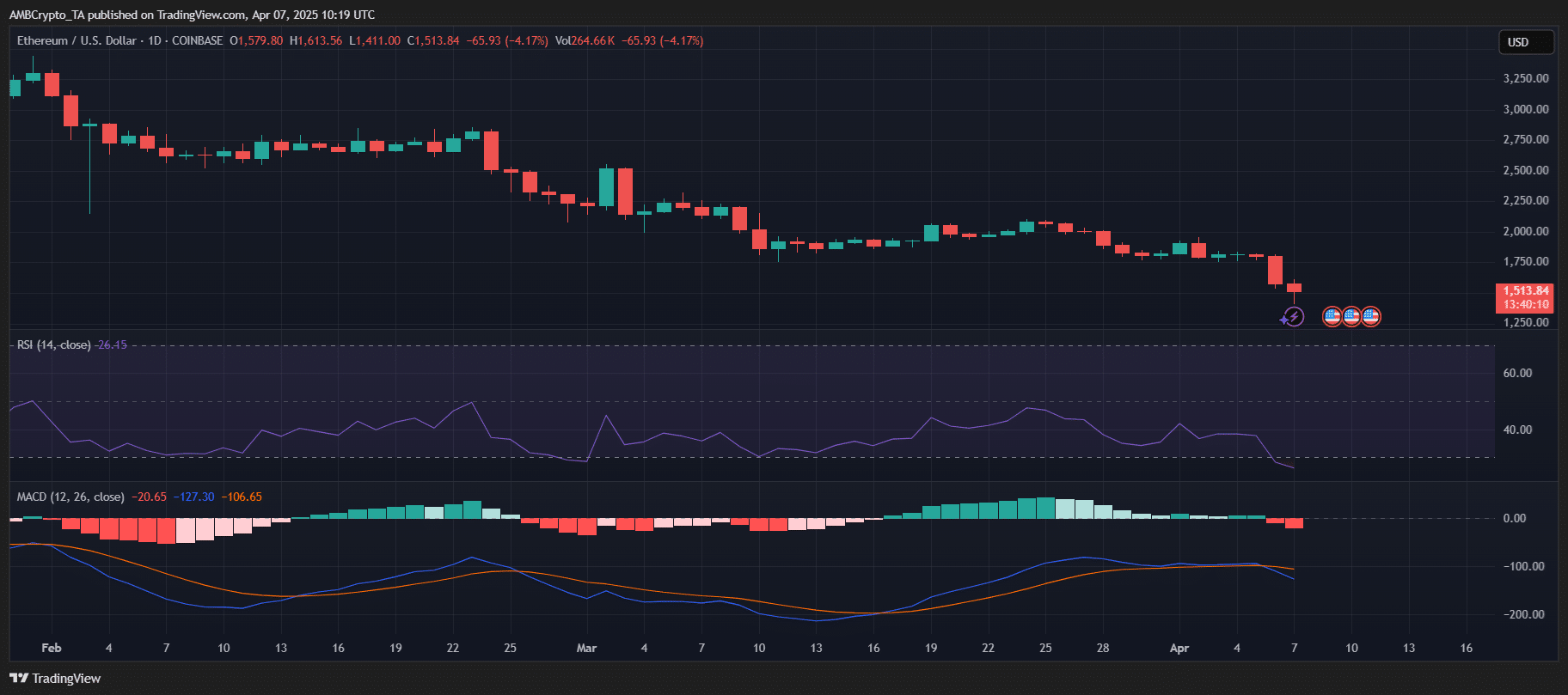

Ethereum’s worth outlook

Ethereum fell to $1,513 at press time, marking a 4.17% drop and lengthening its multi-week downtrend. The RSI plunged to 26.45, deep into oversold territory, indicating intense promoting stress. The MACD histogram flashed detrimental, with the Sign line far beneath zero – A traditional affirmation of bearish momentum.

Notably, no bullish divergence appeared to be seen, suggesting there’s little signal of reversal. Until ETH finds assist above $1,480, the following psychological ground would lie close to $1,300.