- A surge in Ethereum Layer 2 options have offloaded some transactions.

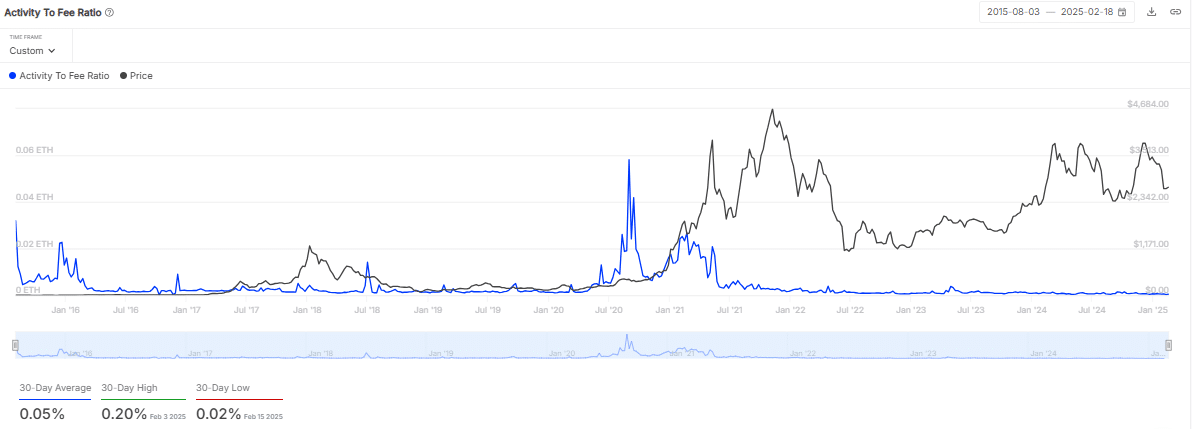

- Lower in community exercise as exercise to payment ratio depict may have a hand on this decline.

Ethereum’s [ETH] blockchain, which is on the heart of powering many initiatives throughout the crypto ecosystem together with DeFi and NFTs, witnessed a staggering 70% crash in fuel charges, hitting a four-year low as of the twentieth of February.

The every day charges dropped from $23 million to $7.5 million.

In keeping with information from IntoTheBlock, the common fuel value has plummeted to round 5 gwei, translating to roughly $0.80 per transaction — a pointy decline from the $20-plus charges seen throughout peak exercise in 2024.

This has left analysts and customers pondering the forces behind this drop. Two major drivers have been surge in Ethereum L2s offloading transactions and a lower in mainnet community exercise.

Rise of Ethereum L2 options

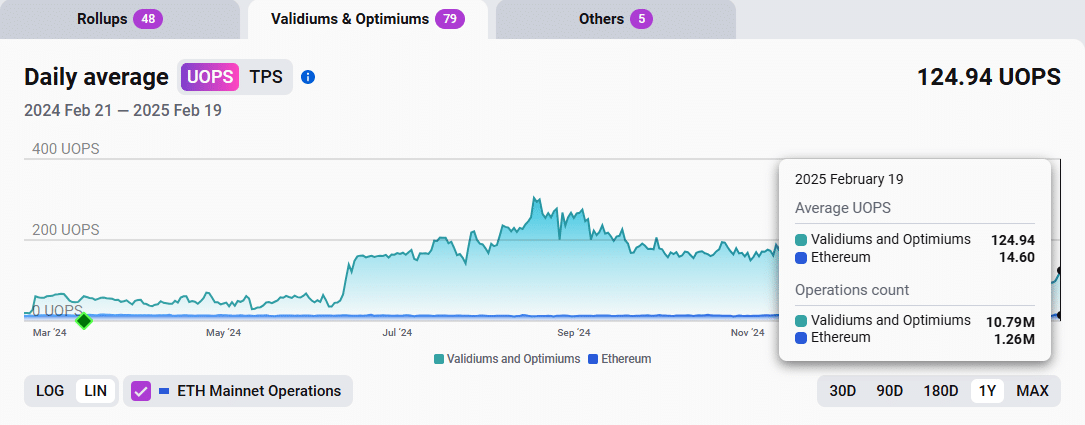

The rise of L2 options like Arbitrum [ARB], Optimism [OP], and Base, which course of transactions off-chain whereas leveraging Ethereum’s safety, has been one of many issue contributing to the low payment values.

L2 networks now deal with over 1.5 million every day transactions mixed, up from 800,000 a 12 months in the past.

Following the Dencun improve which launched “blobs” to cut back L2 information prices, fuel charges on these networks have dropped by as a lot as 90%, with some costing mere cents.

For Rollups, information is posted however nonetheless scale back exercise on the mainnet.

Validiums and Optimiums, just like Rollups, additionally periodically submit state commitments of transactions which might be validated by Ethereum, nonetheless information just isn’t posted on the mainnet.

Declining community exercise

In the meantime, ETH’s mainnet noticed a slowdown with decline in every day transactions from 1.2 million in January 2024 to only over 900,000 in February 2025.

This dip aligned with volumes on DEXs falling to $2.62 billion every day, down from a 2024 peak of $5 billion.

The waning hype round memecoins and speculative NFT drops has additional softened demand for block house.

For the reason that Dencun improve, ETH issuance has exceeded burns by 197,000 ETH, or $500 million, indicating decreased payment strain.

Cheaper transactions may spur adoption, however there may be potential for challenges as that L2 fragmentation may dilute liquidity.

As L2s like Base — boasting $8 billion in TVL — proceed to thrive, Ethereum’s mainnet might evolve right into a safety spine relatively than a transaction hub.