Ethereum is approaching a pivotal second because it pushes to reclaim the $2,600 degree, aiming to interrupt free from weeks of sideways motion. After buying and selling inside a good vary since early Might, ETH is now testing the higher boundary of its consolidation zone, a transfer that might mark the beginning of a brand new bullish part for the world’s second-largest cryptocurrency.

Associated Studying

Market members are intently watching this degree, as a profitable breakout above $2,600 would probably appeal to momentum patrons and make sure renewed power throughout the altcoin sector. Nevertheless, the breakout is much from assured. If bulls fail to maintain this transfer, Ethereum may face renewed promoting strain, with worth probably revisiting decrease assist zones.

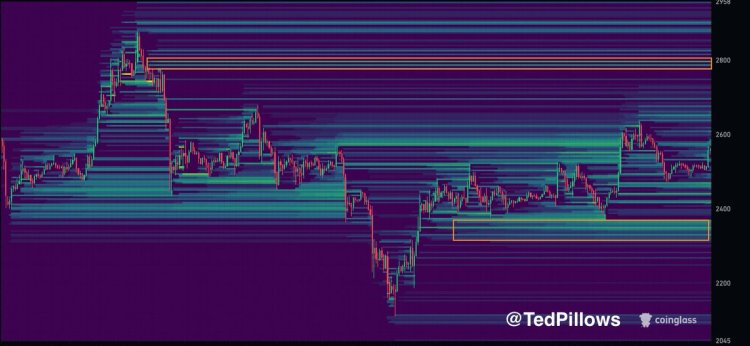

In accordance with Coinglass information, liquidity clusters are clearly outlined at $2,800 and $2,350. These ranges will probably act as magnets within the coming days, relying on how Ethereum responds to present resistance. A clear break towards $2,800 would verify bullish intent and broader altcoin surges, whereas a rejection may reinforce bearish sentiment.

Ethereum’s Subsequent Transfer Might Ignite Altseason

Altcoins stay almost 50% under their all-time highs, however bullish momentum is quietly constructing. Ethereum, the chief of the altcoin market, has been consolidating in a well-defined vary between $2,400 and $2,700 since early Might. This extended sideways motion has saved a lot of the altcoin sector in a state of indecision. Now, merchants and analysts agree: Ethereum should get away to guide the subsequent main transfer.

Market analyst Ted Pillows identifies two key liquidity ranges for ETH: $2,800 on the upside and $2,350 on the draw back. These zones characterize the most certainly locations for worth within the quick time period, relying on which facet of the vary breaks first. If Ethereum pushes above $2,800 with power, it might probably set off renewed threat urge for food and a broad-based altcoin rally. Then again, a breakdown under $2,350 may result in deeper corrections throughout the board.

To date, bulls have defended the $2,500 degree nicely, and rising open curiosity means that buyers are positioning for an enlargement. A decisive breakout in both path will resolve weeks of consolidation and decide the short-term pattern. Till then, Ethereum stays the gatekeeper of altcoin momentum—its subsequent transfer may outline the trail for all the market.

Associated Studying

ETH Exams Resistance Amid Vary-Certain Construction

Ethereum is at present buying and selling at $2,563, hovering just under the $2,600 mark, a degree that has acted as short-term resistance all through June and early July. As proven within the 12-hour chart, ETH has been trapped in a horizontal consolidation construction between $2,400 and $2,700, with a number of failed makes an attempt to interrupt both facet convincingly.

The worth stays above the 50, 100, and 200 easy shifting averages (SMAs), which is a optimistic sign for bulls. The 100 SMA at $2,532 and the 200 SMA at $2,206 have provided sturdy dynamic assist throughout latest pullbacks, reinforcing the present uptrend construction.

Quantity stays average, suggesting that market members are ready for a transparent breakout earlier than getting into with conviction. A decisive shut above $2,600 would open the door for a transfer towards $2,800, the place giant liquidity clusters have been recognized by Coinglass.

Associated Studying

Nevertheless, failure to keep up this short-term momentum may push ETH again towards the $2,400 assist zone. Bulls have defended this degree a number of instances, and a break under it might probably invalidate the bullish setup and enhance the danger of a deeper correction.

Featured picture from Dall-E, chart from TradingView