- Wall Road rally boosts hopes of a Bitcoin all-time excessive amid Fed price reduce optimism.

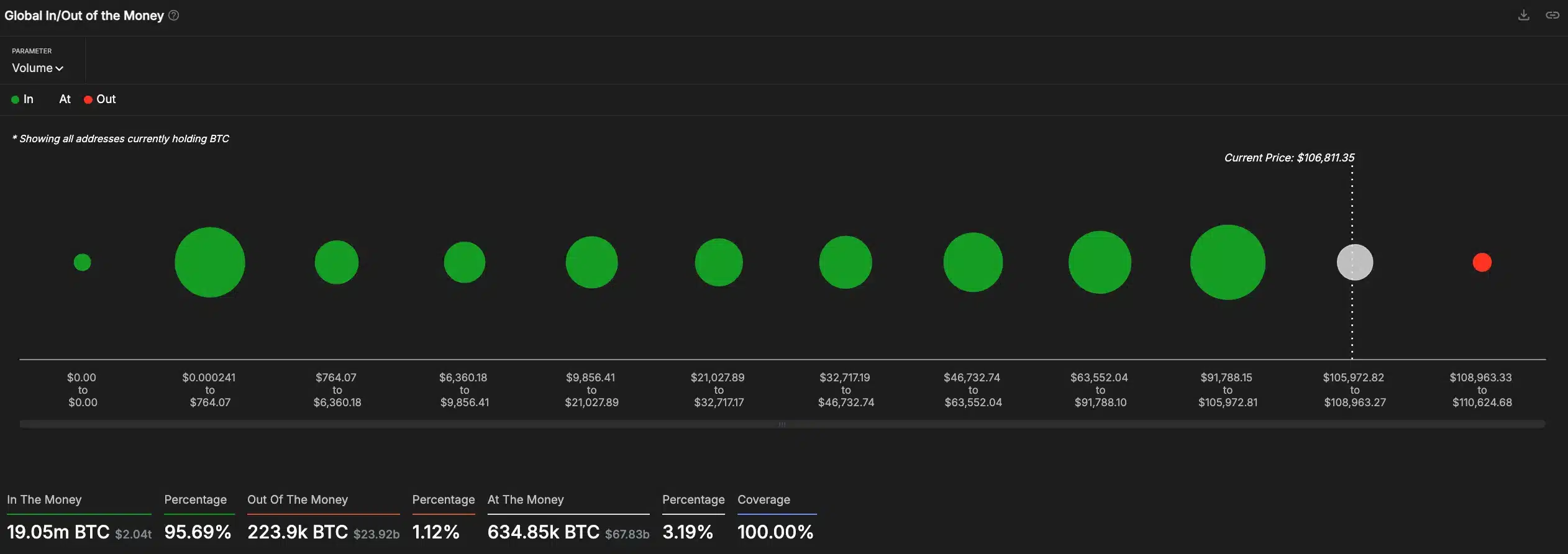

- 95.69% of BTC holders are in revenue, indicating sturdy bullish market sentiment.

Wall Road witnessed a broad-based rally on the twenty sixth of June, with all three main U.S. indexes climbing greater amid easing geopolitical tensions and promising financial alerts.

The continued ceasefire between Israel and Iran, coupled with knowledge supporting potential rate of interest cuts by the U.S. Federal Reserve, helped push the S&P 500 and Nasdaq nearer to their document closing highs.

U.S. shares break information

Notably, S&P 500 Futures surged to a contemporary all-time excessive of 6,145, eclipsing February’s earlier peak, whereas Nasdaq Composite futures additionally reached a brand new excessive at 20,180.

This bullish sentiment mirrored a market restoration, with the S&P 500 rebounding by 23% since its plunge on the eighth of April, as fears over commerce tariffs and conflict-driven volatility started to subside.

What’s extra

As anticipated, the current surge in U.S. equities has fueled hypothesis that the Federal Reserve might provoke rate of interest cuts as early as July, a transfer that has energized each conventional and crypto markets alike.

Echoing related sentiments was Invoice Northey, senior funding director at U.S. Financial institution Wealth Administration, Billings, Montana, who added,

“Clearly, the pull ahead of price cuts into 2025 is without doubt one of the extra vital components. Expectations now level to a few price cuts this 12 months.”

In response, many within the crypto house are anticipating a bullish breakout for Bitcoin [BTC], with expectations that it might quickly comply with the inventory market’s lead and chart a brand new all-time excessive.

Combined neighborhood response

Echoing this sentiment, BitMEX founder Arthur Hayes confidently predicted that Bitcoin ATHs are on the horizon, tying crypto’s trajectory intently to Wall Road’s record-breaking rally.

He stated,

Nonetheless, not everyone seems to be cheering for Bitcoin to achieve a brand new all-time excessive. As one X consumer identified, skepticism stays.

Bitcoin’s present pattern and what lies forward

In the meantime, on the time of writing, Bitcoin was buying and selling at $106,996.63 after a minor 0.38% dip over the previous 24 hours, in line with CoinMarketCap.

Whereas the Bulls And Bears indicator confirmed a close to impasse, with bears barely forward at 122 in comparison with bulls at 120, on-chain knowledge pointed to a extra optimistic outlook.

AMBCrypto’s evaluation of IntoTheBlock knowledge revealed that almost 95.69% of BTC holders have been in revenue, signaling sturdy bullish sentiment and the potential for additional upward motion.

Nonetheless, seasonal traits might mood expectations. Traditionally, Q3 has been Bitcoin’s weakest quarter, with common returns of simply 6%, in line with CoinGlass.

Whereas, July typically defies this pattern with a median acquire of seven.5%, whereas August and September are inclined to underperform.

Analysts attribute this seasonal dip to lowered buying and selling quantity throughout summer season holidays.

Due to this fact, whereas historic patterns recommend a cautious strategy, the present profitability of holders and market sentiment might tilt the steadiness in favor of additional positive factors.

However buyers ought to keep in mind that previous traits are not any assure of future efficiency.